At a time when global environmental governance is accelerating, policy leverage is becoming a decisive force in reshaping the plastics industry. With 127 countries legislating to restrict traditional plastic products, the material revolution driven by regulatory enforcement has broken through the boundaries of the laboratory and has begun to systematically reconstruct the industrial chain from production to consumption. This regulatory network woven by government bans, extended producer responsibility systems, and circular economy standards has not only accelerated the commercialization of alternatives such as polylactic acid and cellulose-based materials, but has also driven the recalibration of industrial civilization and ecological carrying capacity at a deeper level.

1. Policy-driven Replacement and the Phasing Out of Traditional Plastics

①National-level bans on plastic accelerate

Southeast Asia: Indonesia's 'National Plastic Substitute Plan 2024-2029' mandates that biobased materials like PLA must account for at least 25% of food packaging, with violators facing packaging taxes (an additional $0.15 per PE cup). Vietnam has implemented the 'Circular Economy Law,' which will ban imports of PE-coated paper cup production equipment starting in 2025 .

- Latin America: Chile's 'Environmental Responsibility Act 2024' requires chain restaurants to use more than 50% biodegradable packaging, leading to a 62% annual increase in PLA cup purchases.

②Pressure transmission from international conventions

Emerging market export companies are proactively switching raw materials to meet the EU's CBAM carbon tariffs requirements (PLA cups have a carbon emission coefficient that is only 35% of traditional PE). For example, Thai paper cup exporter Toyo Seikan plans to increase its PLA cup production capacity from 12% to 40% by 2024 to retain European orders.

2. Localization of the supply chain and cost reduction

①Regional layout of raw material production

China Fengyuan Group has built a 500,000-ton/year polylactic acid (PLA) plant in Malaysia, reducing the landed price of PLA pellets in ASEAN countries from $3,200 per ton in 2023 to $2,650 per ton in 2025, narrowing the cost gap with polyethylene (PE) to within 1.3 times.

- India's Reliance Industries has developed PLA technology based on sugarcane bagasse, achieving over 90% local raw material usage, resulting in a 18% lower production cost per cup compared to imported PLA.

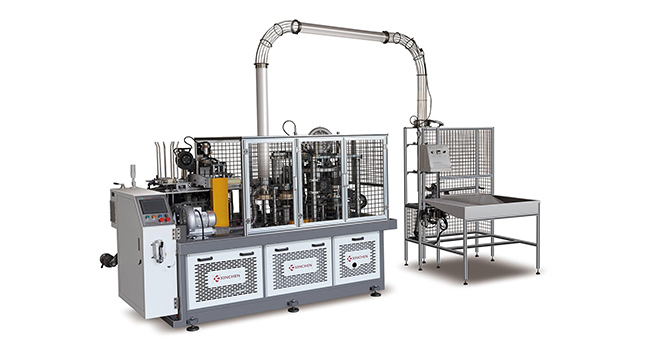

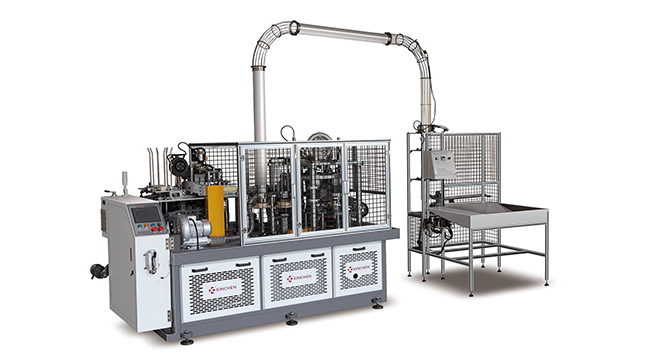

②Breakthrough in device compatibility

China's Daxiang Machinery has launched a 'tropical climate version' PLA coating machine to address the issue of unstable PLA crystallinity in high-temperature and high-humidity environments in Southeast Asia. This has reduced production line failure rates from 15% to 3%, boosting PLA cup production capacity in countries like Vietnam and the Philippines by 35% annually.

3.Consumer Upgrading and Brand Chain Drive

①Multinational corporations are pressuring their supply chains to adapt.

International brands like KFC and McDonald's are breaking down their '100% globally compostable packaging by 2030' goal into targets for each subsidiary. In the Philippines, stores must reach a mandatory 60% usage of PLA cups by 2025, driving local suppliers to transform.

Starbucks has launched a 'PLA Cup Double Rewards Program' in Mexico, where customers earn double loyalty points for every PLA cup used. Within three months, the selection rate of PLA cups jumped from 27% to 58%.

②Domestic brands engage in differentiated competition

The Indonesian tea chain brand Chatime has launched a 'Carbon Footprint Visualization PLA Cup,' which features a QR code that allows customers to trace the carbon emissions of its production. In 2024, this product line drove a 41% increase in store traffic and a 22% rise in per-customer spending.

Conclusion

The paper cup machine's technological evolution epitomizes the irreversible trajectory of plastic substitution. As policy mandates and carbon tariffs dismantle traditional plastic ecosystems, breakthroughs in localized PLA production and climate-adaptive coating systems—exemplified by Daxiang Machinery’s tropical-ready equipment—are erasing technical barriers. Simultaneously, multinational brands’ decarbonization roadmaps and consumer-driven carbon accountability mechanisms are forging closed-loop value chains. This triad of regulatory coercion, industrial innovation, and market pull signals the final phase of polyethylene’s dominance, where paper cup production lines no longer serve as plastic vectors but become nodes in a regenerative material network.

Apr 11,2025

Apr 11,2025