The paper cup industry is undergoing a strategic realignment shaped by sustainability mandates, regional policy shifts, and advancements in paper cup machine technology. Mature markets in Europe and North America are prioritizing carbon-neutral upgrades and intelligent manufacturing, while Asia-Pacific and Southeast Asia emerge as growth hubs balancing cost efficiency with technological exports. Emerging markets in Africa and Latin America are leveraging green finance and resource advantages to leapfrog into eco-friendly production. Across all segments, paper cup machine innovation—from PLA-compatible systems to AI-driven automation—serves as the core enabler of market opportunities, with a projected $5 billion upgrade wave by 2026.

Mature Markets: Technological Upgrades in Europe and America and Policy Pressures

①Europe: The Vanguard Battlefield for Carbon Neutrality

Regulation-driven: The EU's SUPD 2.0 mandates the phasing out of PE-coated paper cup machines by 2026, with subsidies for PLA/bio-based coated equipment reaching up to 30% (maximum of 500,000 euros per company), driving a 67% increase in sales of HT-PLA models by German KRONES and Italian SACM among others. Circular economy opportunities: French Veolia has established a 'PLA cup recycling-regenerated pulp' closed-loop system, requiring equipment to handle high proportions of recycled fibers (≥60%), creating demand for integrated sorting-crushing-re-pulping machines (market size expected to reach 1.2 billion euros by 2028).

②North America: Dominated by Intelligent and Flexible Manufacturing

Technological dividends: The American Paper Machinery Corp has launched an AI dynamic parameter adjustment system, supporting the production of up to 800,000 custom cups per day per machine (minimum order quantity of 200 cups), which has attracted a surge in orders from clients such as Starbucks and McDonald's.

Cost competition: Canada's carbon tax has risen to 170 Canadian dollars per ton of CO₂, making the retrofitting cost of traditional PE laminating machines exceed $80,000 per unit. This has forced small and medium-sized manufacturers to relocate to the US-Mexico border area (in Q1 2025, Mexico's imports of paper cup machines increased by 89% year-on-year).

2.Growth Engine: Reconfiguration of Production Capacity in Asia-Pacific and Southeast Asia

①China: Technology Export and Domestic Demand Upgradation

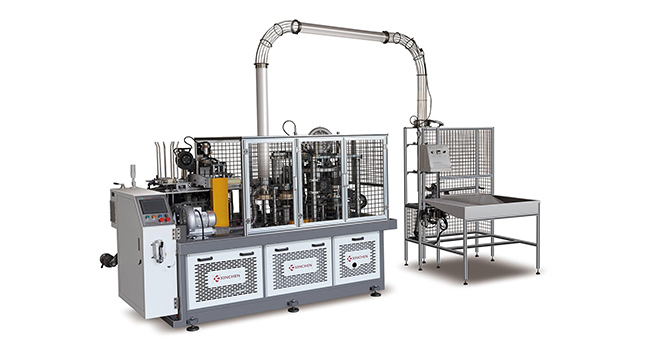

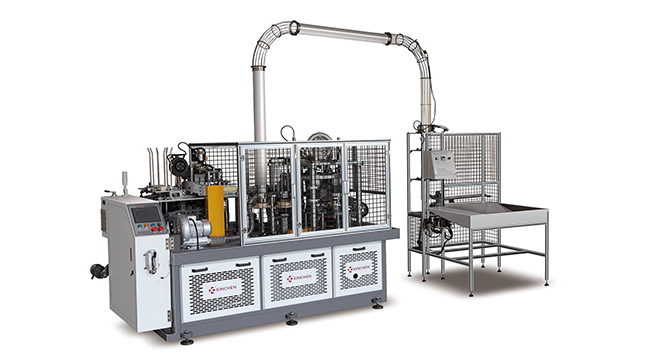

Policy divergence: The eastern coastal regions implement 'Plastic Ban 2.0' (requiring PLA coating penetration rate of 40%), while the central and western regions take over traditional PE production capacity transfers, creating a dual-track market (by 2025, Xinchen Machinery equipped with high-end processing paper cup machine to ensure the precision of paper cup and paper bowl machinery). New growth areas: A surge in demand for cold chain cups (annual increase of 52%) drives the purchase of low-temperature resistant PLA coating machines (-20°C crack resistance) and rapid freezing bonding technology equipment.

②Southeast Asia: Geopolitical Alternatives and Cost Advantage

Tariff benefits: Under the RCEP framework, ASEAN's PLA cup exports to the EU enjoy a 5.8% lower tariff compared to those from China. Companies like Vietnam's An Phat Holdings are making large-scale purchases of high-speed PLA laminating machines from China (with over 60% of models capable of producing more than 400 cups per minute).

Raw material localization: Thailand's Indorama has built the world's largest PLA factory based on sugarcane residue (producing 300,000 tons annually), reducing regional

3.Emerging Markets: Awakening Demand in Africa and Latin America

①Africa: Policy-driven and Model Innovation

Green finance boost: The African Development Bank offers loans for a 'cup machine-compost plant' linked project (interest rates as low as 3.5%), enabling Kenya's Bio2Watt company to establish East Africa's first PLA cup recycling industrial park, reducing equipment investment payback period to 2.1 years.

Local production rise: The Egyptian government requires multinational consumer goods brands to source at least 35% locally

②Latin America: Resource Endowments and Carbon Trade Dividends

Material advantages: Brazil's breakthrough in cellulose nanocrystal coating (CNC) technology, using eucalyptus pulp as the base, results in waterproof cups that are 18% cheaper than PLA.

The equipment requires adaptation for low-temperature forming processes (70°C compared to PLA's 160°C). Carbon credit monetization: Colombia has included PLA cup

4.The critical window of opportunity for the next three years

①Technological substitution tipping point: By 2026, the mass production of fourth-generation PLA coating capable of withstanding 130°C will trigger a wave of equipment upgrades in the hot beverage market, releasing over $5 billion in demand.

②Regional policy node: By 2027, ASEAN will unify standards for bio-based materials. The China-Southeast Asia 'equipment for market' model may become mainstream.

③Carbon trading deepens: Global carbon prices break $100 per ton, PLA coating machine's carbon credit generation capability becomes a core competitive advantage.

The global paper cup industry chain is undergoing multi-dimensional reconstruction, with technology iteration and regional policies forming a resonance effect. The mature markets in Europe and the United States are polarized: the EU relies on the SUPD 2.0 policy to drive the elimination of PE coating equipment, generating a demand for 1.2 billion euros of recycled fiber processing equipment; North America reshapes its competitiveness through intelligent flexible manufacturing technology (such as 800,000 customized production capacity per day), and the carbon tax leverage accelerates the transfer of production capacity to the Mexico-US border. The Asia-Pacific market presents structural opportunities, and the east and west of China form a dual-track pattern of "environmental protection upgrade + traditional inheritance". Southeast Asia attracts 60%+ high-speed PLA laminating machine capacity layout with the RCEP tariff dividend. Africa's green financial model (3.5% interest rate equipment loan) and Latin American resource innovation (Brazil's 18% cost advantage CNC coating technology) have opened up new tracks. The industry's critical point will emerge in 2026. The mass production of the fourth-generation 130°C resistant PLA coating will release $5 billion in equipment upgrade demand. Combined with the unification of ASEAN bio-based material standards (2027) and the global carbon price breaking through $100/ton, intelligent and low-carbon paper cup machinery will become the core fulcrum for the reconstruction of the value chain, driving a deep reshuffle of the global production capacity map.

Apr 16,2025

Apr 16,2025